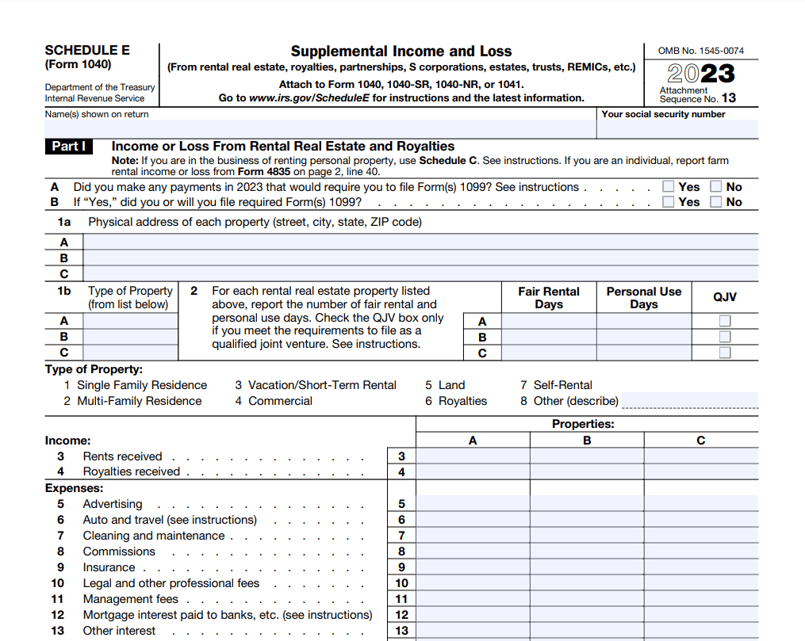

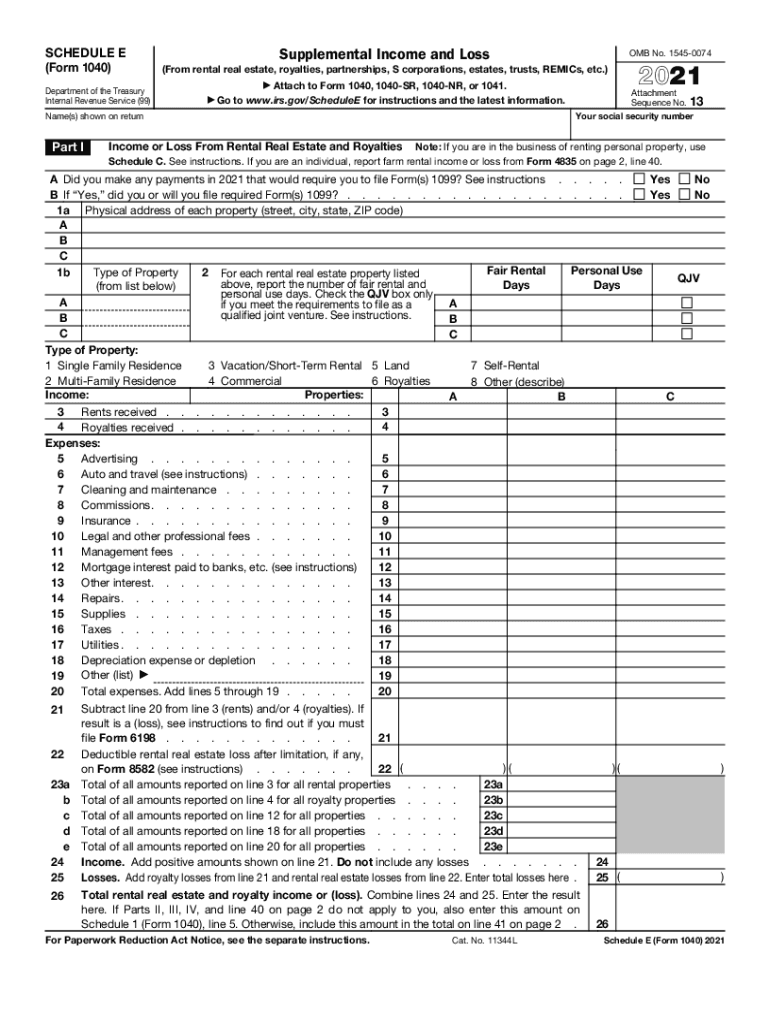

2024 Schedule E Form 1099 – Millions of taxpayers who generate income via online platforms may be receiving Form 1099-K for the first time. . Form 1099-MISC, for Miscellaneous Income For rents or royalties, you will typically complete Schedule E, Supplemental Income or Loss, and then transfer the applicable amount to Form 1040. .

2024 Schedule E Form 1099

Source : www.therealestatecpa.comMastering Schedule E: Tax Filing for Landlords Explained

Source : www.turbotenant.comUnderstanding the Schedule E for Rental Properties — REI Hub

Source : www.reihub.netE1204 Form 1040 Schedule E Supplemental Income and Loss (Page 1

Source : www.greatland.comIRS moves forward with free e filing system in pilot program to

Source : www.sandiegouniontribune.comE File Form 1099 NEC Online in 2024! BoomTax

Source : boomtax.comUM offering limited program to help taxpayers with moderate income

Source : www.kpax.comThe 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors

Source : www.therealestatecpa.comSchedule e: Fill out & sign online | DocHub

Source : www.dochub.comHR Calendar 2024: Compliance Deadlines, Federal Holidays, Rules

Source : www.etsy.com2024 Schedule E Form 1099 The 2024 Ultimate Guide to IRS Schedule E for Real Estate Investors: The new FAQs are in addition to the recently updated webpage, “Understanding Your Form 1099-K.” The revised FAQs include guidance on common situations, along with more clarity for the payment card . Each January, your mailbox and e-mail is likely mutual funds or ETFs on Schedule D, Capital Gains and Losses. There are some situations in which money reported in a 1099 form is not taxable .

]]>